I lead a Product team at Reddit, where LLMs are at the heart of nearly all our work. Like everyone with a mobile phone today, I use AI tools daily and remain excited about its potential.

But I also follow the financial markets - where there's increasing chatter about a potential AI bubble. Some recent examples:

What finally caught my attention was this stat from an NYT article by Natasha Sarin (via Marginal Revolution): "To provide some sense of scale, that means the equivalent of about $1,800 per person in America will be invested this year on AI". That is a bucketload of spending.

So I decided to form my own POV. I plan to share the facts as I see them and what I think will likely happen - as of early Oct 2025.

Stylized Facts on AI today: 1. CapEx Ratios are Highly Inflated; 2. AI's P&L Impact Takes Time to Materialize; 3. Valuations Haven't Reached Previous Peak Levels; 4. IPO Activity Remains Subdued; 5. Interest Rates Are Structurally Higher; 6. Private Credit Boom Is Fueling Infrastructure Spend; 7. GPU Depreciation Schedules Don't Match Reality

Potential Paths Forward: 1. P&L Impact is First Seen in Marketing Expenses and Engineering Opex; 2. A Short-Term Correction but Long-Term Trend Continues; 3. Spend Reallocations are Not Incremental; 4. The Big Unknown: New Categories We Can't See

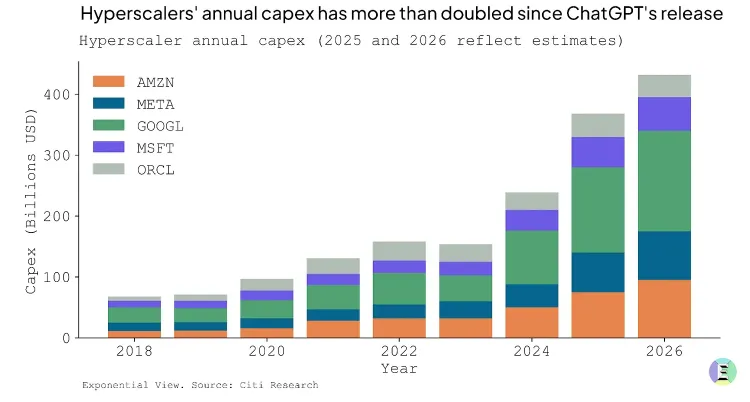

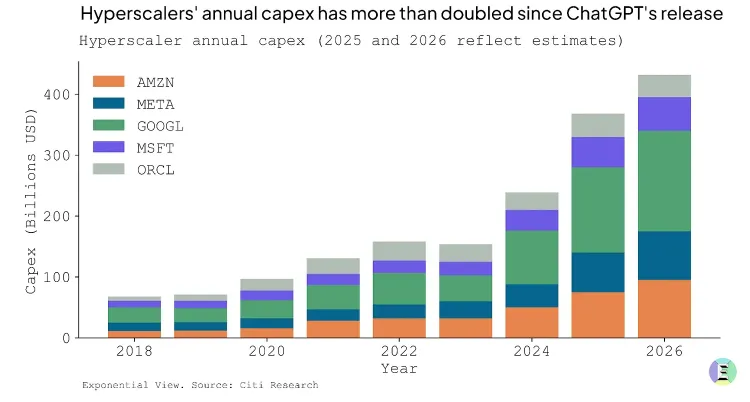

Hyperscalers (Microsoft, Amazon, Alphabet and Meta) historically ran capex at 11-16% of revenue. Today they're at 22%, with revenue YoY growth in the 15-25% range (ex Nvidia) - capex spending is dramatically outpacing revenue growth. The four major hyperscalers are spending approximately $320 billion combined on AI infrastructure in 2025 - with public statements on how this will likely continue in the coming years.

[This math is directional at best but --] Assuming the recent to current 15-22% capex-to-revenue ratio holds, every dollar of investment should generate roughly $4.5 - $6.5 in annual revenue to maintain historical return profiles. This implies the market will likely expect these investments to generate $1.4-2.1 trillion in incremental annual revenue. And as these players continue to invest in improved GPUs and AI infrastructure, the required incremental revenue grows. For context: During the telecom boom of the late 1990s, the top carriers increased capex from 15-18% of revenue to 25-30%.

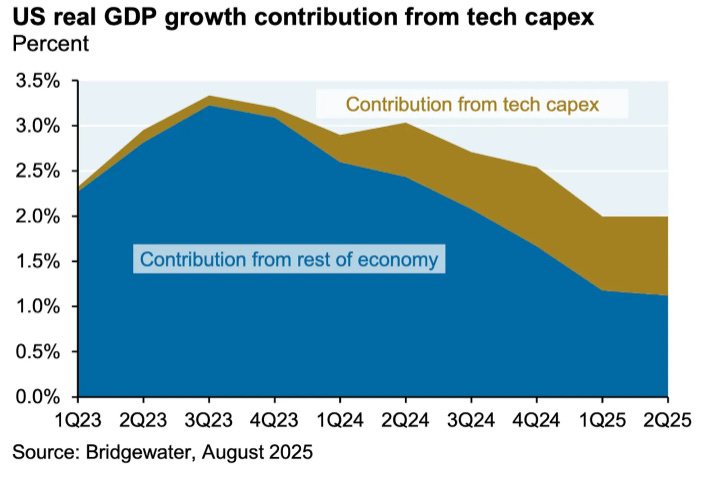

This is even showing up in macroeconomic metrics. ~40% of the US real GDP growth last quarter was driven by tech capex.

MIT's NANDA initiative found that about 5% of AI pilot programs work in reality — and this report and a host of "takes" invaded our Linkedin Feeds for a few weeks. The core issue isn't model quality but the integration needed into existing workflows. A friend who runs an SMB roll-up and is investing in AI-led operational improvements concurs - it isn't showing up in P&Ls yet.

While this means opportunity remains, it will take time for the scale of the incremental revenue needed ($1.4T+ annualized) to actually translate.

I pay more attention to enterprise because I also believe that AI will not result in net-new consumer platforms in the near-term (beyond ChatGPT, of course). I expect most AI-driven revenue to come from existing line items in enterprise P&Ls.

Current valuations, while elevated, remain "much lower" than prior tech bubbles. The Nasdaq's forward P/E ratio is ~28X today. At the 2000 peak, it exceeded 70X. Even in 2007 before the financial crisis, tech valuations were higher relative to earnings than they are now.

Looking more closely, the MAG7 — who are spending the majority of this capex — has a blended P/E of ~32X — expensive, as Coatue's Laffont brothers said in June, but not extreme relative to past tech bubbles.

Tech IPO volume hasn't approached previous boom levels. In 1999, there were ~500 IPOs in the US. In 2021 — the peak of the recent SPAC/IPO boom — there were ~400. In 2023, just ~100. Additionally, the class of 2021 bubbles are trading 50% below their listing price (from Coatue).

That said, IPOs are not a great indicator in 2025 when private markets are now massive. Stripe is 14 years old, valued at $70 billion, still private. OpenAI is 9 years old and valued at $500 billion, with no public IPO timeline. Anthropic, founded in 2021, valued at $180 billion, is also private. Companies don't need public markets to raise significant capital — so comparing the number of IPOs is likely not a great measure of frothiness.

The federal funds rate is 4.75-5.00% versus near zero for most of the 2010s. During the late 1990s, rates averaged 5-6%, but has begun declining into the 2000 crash.

Higher rates should, in theory, compress valuations. Yet tech valuations have remained stable despite the dramatic capital expenditures (Meta's capital heavy foray into VR stands in contrast). This suggests that either: (a) investors believe AI growth rates are high enough to overcome the discount rate, or (b) there's so much capital with nowhere else to go that it's ignoring traditional valuation discipline.

Of note: points (3), (4) and (5) are what Goldman's Americas Technology equity research is forming their view that we are not in a bubble in the next year.

I've learned a lot from Matt Levine's recent posts about Private Credit. While this is probably safer for the ecosystem on-net (versus traditional bank lending with short-term liabilities that fund long-term assets). Private credit AUM has grown 10X to $1.7 trillion in 2025 since the financial crisis.

Some of these transactions are unusual and involve related parties e.g., OpenAI paying for AMD's chips partially with AMD's own stock. AI firms are shifting huge amounts of AI spending off their books into SPVs that disguise the cost of the AI build-out. First Balance's recent bankruptcy is the first instance of a breakdown that involves private creditors being impacted. Meanwhile, Blackstone raised $70 billion for data center infrastructure in 2024. Oracle, Microsoft, and CoreWeave have structured billion-dollar data center deals financed through private credit rather than balance sheet capex.

I find this notable given that the MAG7 combined had $324 billion in free cash flow in 2024. They could afford to fund a majority of this AI capex without leverage. This matters because off-balance-sheet investment creates opacity. When it's in SPVs or structured as customer financing deals, the accountability is murkier. The accounting tricks depress reported infrastructure spending, inflating profits.

Nvidia now unveils a new AI chip every year instead of every two years. Jensen Huang said in March that "when Blackwell starts shipping in volume you couldn't give Hoppers away".

Meanwhile, companies keep extending depreciation schedules. Microsoft: 4 to 6 years (2022). Alphabet: 4 to 6 years (2023). Amazon and Oracle: 5 to 6 years (2024). Meta: 5 to 5.5 years (January 2025). Amazon partially reversed course in January 2025, moving some assets back to 5 years, noting this would cut operating profit by $700m.

The Economist analyzed the impact: if servers depreciate over 3 years instead of current schedules, the AI big five's combined annual pre-tax profit falls by $26bn (8% of last year's total). Over 2 years: $1.6trn market cap hit. If you take Huang literally at 1 year, this implies $4trn, one-third of their collective worth. Barclays estimated higher depreciation costs would shave 5-10% from earnings per share.

There are two AI-driven areas that have found PMF in enterprise: Digital Ads and Coding. I think these are the two areas we should first see incremental AI-driven revenue.

On digital ads: The MAG7 that are heavy on advertising (Meta, Google, Amazon) will see benefits first. Advertising platforms will start seeing higher ROAS from better ad targeting models driving incremental revenue (although this may not be cleanly attributed to AI). This will happen first because these improvements will require little-to-no change for customers - benefits will accrue from the platforms to the broader industry faster than other sectors which may require integrations into existing workflows.

On headcount: The other area of enterprise PMF is in coding. We're already seeing software engineering hiring slow - companies will accomplish more, faster with fewer FTEs. This also means that MAG7 and the broader Tech sector will benefit dramatically. We should then start seeing this show up in labor markets, starting with more layoffs.

The required incremental annual revenue will materialize, but just not in 3-5 years. Which means we will likely see a period of flat-to-modest growth while P&L impact catches up to infrastructure capacity. Stock multiples will compress, and maybe even crash. Some capex gets cut in 2026-2027, then resumes when we start seeing traction.

Cloud computing took a decade to justify its infrastructure buildout -- as did mobile to gain adoption. AI will likely follow the same path. As Tyler Cowen notes, the O-Ring model implies that the bottleneck will move to other parts of the value chain. Even electricity arguably took half a century to fully diffuse its benefits across the economy.

My bet is that the correction will start with something banal - reports of MAG7 not meeting market expectations of incremental cloud revenue from AI investments, a leaked insider view of how retention is low, the hyperscalers renegotiating their private credit obligations.

For example, say an SMB spends $10M on Salesforce + data analysts + customer service reps. They shift to spending $10M on AI agents + infrastructure instead — with the hyperscalers booking revenue growth. GDP sees limited incremental growth, but employment drops in affected sectors.

This is probably already happening but I don't have data e.g., spend on OpenAI takes from spend on another provider that is not AI but solved the same JTBD.

At the same time, I wonder if not all of the MAG7 companies win. Maybe 2-3 capture 80% of AI value - does AWS lose versus Google Cloud or Azure given their lack of access to a cutting-edge foundational model and relative lower investment levels in AI capex?

This has happened in every tech cycle. The infrastructure phase looks like everyone wins, but the next phase reveals who actually has sustainable advantages.

In 2007, no one predicted the App Store would create a $200B+ economy. It's almost certain that AI will enable entirely new categories of value creation we can't predict. That said, I would be surprised if at-scale adoption happens sooner than 2028 given historical adoption curves (2028 implies 4 years from when the capex scaling began).

I wonder if this will be a new player or the two new AI platforms (OpenAI and Anthropic). The answer likely depends on whether foundation models become commoditized. Will antitrust regulations allow the MAG7 to acquire these companies?

The bull case rests on (a) the hyperscalers executing perfectly with (b) adoption accelerating and expanding revenue/margins and (c) the MAG7 takes a large share of this upside. My instinct says that the probability that all this happens in the next few years is low.

Overall - we live in fascinating times. I like how Philippe Laffont framed it at EMW earlier this year: it's such an interesting set of questions - why is Amazon investing less than their peers in capex? Will that impact AWS's competitiveness versus Azure and Google Cloud? What is Apple's bet likely to be? What happens to online search? How will the digital ads ecosystem change?

I plan to update this article as more perspectives emerge. Overall - I'm convinced the current state cannot continue for longer - something significant will have to change in 2026.